Excel Tiered Commission vs. Flat Commission: Pros and Cons

Commission structures play a pivotal role in motivating sales teams and driving business growth. They serve as a critical component of sales compensation, directly impacting the performance and productivity of sales representatives.

Understanding and implementing commission models in Excel can significantly influence sales outcomes and overall business success. In this blog, we will delve into the two prominent commission models: Excel Tiered Commission vs. Flat Commission. Both models have their own sets of advantages and challenges.

By comparing these two, we aim to provide valuable insights to help you choose the best commission structure for your sales team and business operations.

For more advanced Excel applications in sales-driven industries, check out our guide on real estate financial modeling in Excel which includes detailed revenue projections and investment analysis.

Understanding Flat Commission

Flat commission structures are one of the most straightforward and commonly used models in sales compensation. In a flat commission structure, sales representatives earn a fixed rate or percentage for each sale they make, regardless of the total sales volume or the value of individual sales. This model provides a consistent and predictable method of compensation, making it easy to understand and manage.

How Flat Commissions Work

Flat commissions operate on a simple principle: for every sale completed, the sales representative receives a predetermined amount of money or a fixed percentage of the sale’s value. Here’s a breakdown of the typical workings of flat commission calculation:

- Fixed Rate: In this approach, the commission is a set amount for each sale. For example, if a salesperson earns a $50 commission for each product sold, they will receive $50 for every sale, irrespective of the product’s price.

- Fixed Percentage: Alternatively, the commission can be a consistent percentage of the sales value. For instance, if the commission rate is set at 5%, a salesperson will earn 5% of the revenue generated from each sale. Therefore, if they sell a product worth $1,000, they will receive $50 as a commission.

These Excel commission structures are appreciated for their simplicity and ease of implementation. They provide clear and predictable earnings for sales representatives, making it easier for them to understand their potential income and plan their efforts accordingly.

Here are the key features of flat commission:

- Simplicity: The straightforward nature of flat commissions eliminates confusion, making it easier for both the sales team and management to understand the commission structure.

- Easy to calculate: The amount of commission can be easily calculated with the use of a calculator or simple functions in Excel.

- Uniformity: This model ensures that every sale is rewarded equally, promoting a consistent incentive for all sales activities.

Exploring Excel Tiered Commission

The Excel Tiered commission offers a more dynamic and performance-driven approach to sales compensation compared to the flat commission model. In a tiered commission model, the commission rates increase as sales representatives reach specific sales targets or thresholds. This structure is designed to incentivize higher performance by rewarding sales reps with progressively higher commissions as they achieve greater sales volumes.

How Tiered Commissions Work

Tiered commissions operate on a graduated scale, where different levels of sales achievement correspond to varying commission rates. Here’s how these sales compensation structures work:

- Sales Tiers or Thresholds: The first step is defining the sales tiers or thresholds. Sales representatives must reach these specific sales targets to qualify for higher commission rates. For instance, a company might set tiers at $10,000, $20,000, and $30,000 in sales.

- Varying Commission Rates: Each sales tier has an associated commission rate. As sales representatives meet or exceed the sales thresholds, their commission rate increases. For example:

- Sales up to $10,000 might earn a 5% commission.

- Sales between $10,001 and $20,000 might earn a 7% commission.

- Sales over $20,000 might earn a 10% commission.

- Progressive Earnings: The tiered model motivates sales representatives to exceed their sales targets by offering higher rewards for higher performance. As they move into higher sales tiers, their overall earnings increase due to the higher commission rates applied to their sales.

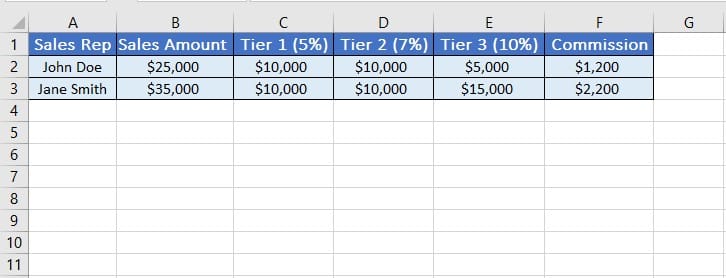

- Consider a sales representative who achieves $25,000 in sales during a given period. Using the tiered commission structure outlined above:

- They would earn 5% on the first $10,000, which is $500.

- They would earn 7% on the next $10,000, which is $700.

- They would earn 10% on the remaining $5,000, which is $500.

- Their commission would be $1,700 for $25,000 in sales.

- Consider a sales representative who achieves $25,000 in sales during a given period. Using the tiered commission structure outlined above:

4. Incentivizes High Performance: This Excel commission calculator encourages sales representatives to aim higher, as reaching the next tier means earning a higher commission rate.

5. Scalability: This structure can be easily scaled to accommodate varying sales goals and business growth, making it suitable for companies with ambitious sales targets.

6. Motivation and Engagement: By offering incremental rewards, tiered commissions keep sales teams motivated and engaged, driving them to achieve and surpass their sales targets.

Analyzing sales data and finding trends is key to understanding the effectiveness of commission structures. For example, you can use Excel to visualize data with tools like a line of best fit. To learn how to create one, check out our guide on creating a Line of Best Fit in Excel.

Pros and Cons of Flat Commission

Each of these two Excel commission tracking methods has its own advantages and disadvantages.

Pros of Flat Commission

Here are the main pros of Flat Commission:

Simplicity and Ease of Calculation

One of the most significant advantages of a flat commission structure is its simplicity. Both sales representatives and management can easily understand and calculate commissions. There are no complex formulas or varying rates to consider, making it straightforward to implement and manage.

Cons of Flat Commission

Here are the cons of Flat Commission:

Lack of Motivation for Higher Performance

While flat commissions are easy to understand, they can lack the motivational drive needed to push sales representatives to exceed their targets. Since the commission rate remains constant, sales reps have little financial incentive to go beyond their usual performance.

May Not Align with Sales Goals or Business Growth

Flat commission structures may not be the best fit for businesses aiming for aggressive growth or higher sales targets. This model does not provide incremental incentives for sales representatives to strive for higher sales volumes. As business goals evolve, a flat commission structure might become misaligned with the company’s objectives, especially if the aim is to encourage larger deals or expand market share.

Pros and Cons of Excel Tiered Commission

Now, let’s consider Excel Tiered Commission vs. Flat Commission. Here are the benefits of Tiered Commission:

Incentivizes Higher Sales Performance

Tiered commission structures are designed to motivate sales representatives to achieve higher sales volumes. By offering progressively higher commission rates for reaching specific sales thresholds, this model encourages reps to push beyond their comfort zones and strive for greater sales.

Aligns with Business Growth Goals

The tiered commission model aligns well with the dynamic goals of a growing business. As the company sets higher sales targets, the tiered structure can effectively encourage sales representatives to meet and exceed these goals.

Encourages Teamwork and Collaboration

When designed thoughtfully, tiered commissions can foster a sense of teamwork and collaboration among sales representatives. For example, setting team-based sales targets can encourage reps to work together to achieve common goals, sharing strategies and best practices.

However, implementing a Tiered Commission structure can be more complicated than a Flat Commission model. Defining appropriate sales tiers, determining the corresponding commission rates, and ensuring accurate commission plan analysis require careful planning and management.

Using a commission comparison spreadsheet for this method necessitates advanced knowledge of functions, formulas, and possibly macros to automate calculations and track progress efficiently. A poorly designed tiered commission structure can lead to unintended consequences, such as demotivation or unfair competition among sales representatives. For example, if the tiers are set too high, sales reps may feel discouraged if they perceive the targets as unattainable.

It is crucial to design the commission tiers thoughtfully, considering factors such as market conditions, sales cycles, and individual capabilities to ensure that the structure is motivating rather than demotivating.

Key Considerations When Choosing Between the Two Models

Consider these Excel commission management tips to choose the most beneficial method when comparing Excel Tiered Commission vs. Flat Commission:

Team Composition

A sales team with a diverse range of experience levels can benefit from a tiered commission structure. In contrast, a flat commission structure might be ideal for a team of largely inexperienced reps, providing straightforward and easily understandable incentives.

Motivation and Performance

A tiered commission structure can offer significant financial motivation for high performers to exceed their targets, while a flat commission provides predictable earnings, which might appeal to those who prefer stability.

Team Dynamics

A tiered commission structure can foster healthy competition, motivating reps to exceed their targets. However, a flat commission model might promote a more collaborative atmosphere, with the team working together towards shared goals without competitive pressure.

Growth Targets

If your business aims for rapid revenue growth, a tiered commission structure might be more effective. By incentivizing higher sales volumes with increased commission rates, you can motivate your sales team to pursue larger deals and more aggressive targets.

Product and Service Focus

If your business strategy involves selling high-value products or services, a tiered commission structure can align well with this goal. It rewards sales reps for closing larger deals, which directly contributes to higher revenue.

Long-Term Strategy

A tiered commission structure can support long-term growth by continuously motivating sales reps to reach higher targets. However, it requires careful management to ensure sustainability and avoid burnout.

Excel Tools and Formulas for Commission Calculations

Excel is a powerful tool for managing and calculating sales commissions, whether you opt for a flat or tiered commission structure. Let’s delve into different Excel formulas and functions suitable for commission plan analysis:

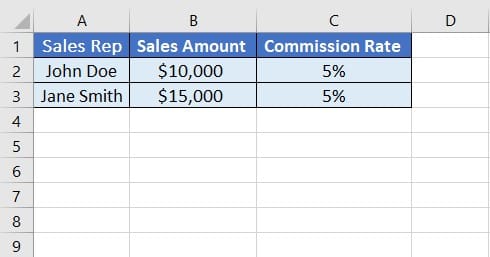

Using Excel for Flat Commission Calculations

Create a spreadsheet with columns for Sales Representative, Sales Amount, and Commission Rate.

Use a formula to calculate the commission for each sale.

Commission = Sales Amount * Commission Rate

Now you can see the amount of commission for each sales rep.

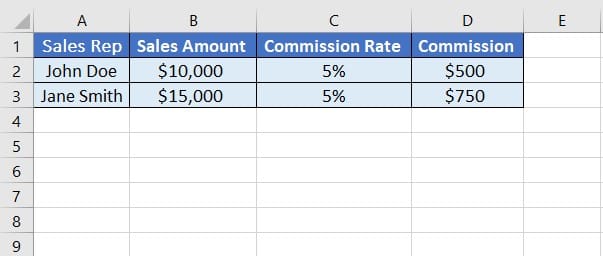

Using Excel for Tiered Commission Calculations

Tiered commission structures are more complex but can be effectively managed in Excel with the right formulas. We developed an Excel application to calculate and manage tiered commissions. It automatically does calculations, manages the tiers of sales reps and produces reports of commissions and sales. Alternatively, here’s a basic example about how to set up tiered commission calculations:

Create a spreadsheet with columns for Sales Representative, Sales Amount, and Commission Tiers.

Use this formula to calculate the commission based on different tiers:

=B2 * IF(B2<=10000, 5%, 0) + (IF(B2>10000, IF(B2<=20000, B2-10000, 10000), 0) * 7%) + (IF(B2>20000, B2-20000, 0) * 10%)

Conclusion

Choosing the right commission structure between Excel Tiered Commission and Flat Commission depends on various factors including team composition, motivation, and business goals. Flat commissions offer simplicity and predictability, making them suitable for novice sales teams and uniform sales cycles.

Conversely, tiered commissions incentivize higher performance and align with ambitious growth targets, though they require careful management to avoid potential drawbacks. Ultimately, businesses should consider their unique needs, market conditions, and sales strategies, using Excel’s powerful tools to calculate and visualize the impacts of each model to make informed decisions.

FAQs

Q1. In what scenarios is a flat commission structure more suitable?

A flat commission structure is more suitable in scenarios where simplicity and predictability are essential. It works well for businesses with high sales volume, uniform sales cycles, and novice sales teams.

Q2. Can Excel assist in visualizing the impact of different commission structures on earnings?

Yes, by using features such as charts, graphs, and conditional formatting, you can compare scenarios, track performance, and forecast earnings.

Q3. How can businesses determine which commission structure is best for them?

Businesses can determine the best commission structure by analyzing sales data, assessing team dynamics, aligning with goals, and piloting models.

Q4. How often should businesses review and adjust their commission structures?

Businesses should review and adjust their commission structures periodically to ensure alignment with changing goals and market conditions. It is advisable to conduct annual reviews, monitor market trends, and gather feedback.

Q5. Are there industry-specific considerations when choosing between commission structures?

Yes, industries with longer sales cycles, high-value products, and competitive markets might benefit more from Excel tiered commission vs. flat commission.

Q6. Can Excel be used to automate commission calculations and reporting?

Excel can automate commission calculations and reporting by using formulas and functions, macros, and templates.

Q7. What are some key performance metrics to consider when evaluating commission structures?

Consider the key performance metrics such as sales volume, revenue generated, average deal size, quota attainment, commission payout, employee retention, and customer acquisition.

Our experts will be glad to help you, If this article didn’t answer your questions. ASK NOW

We believe this content can enhance our services. Yet, it’s awaiting comprehensive review. Your suggestions for improvement are invaluable. Kindly report any issue or suggestion using the “Report an issue” button below. We value your input.