Strategic NPV Calculations: Excel Tips for Financial Decisions

“A Bird in the Hand is Worth Two in the Bush”. This phrase best describes the idea that the money you have in hand now is more valuable than the money you will collect in the future. That’s because you can use it to buy something now and sell it later on for more, make more money by running a business, or simply put it in the bank and get interest. Future money has also less value because inflation erodes its purchasing power. This is known as the time value of money. But how exactly do you compare the value of money now with the value of money in the future? That is where net present value (NPV) comes in.

What is Net Present Value (NPV)?

At its core, Net Present Value is the present value of the cash flows at the required rate of return that a proposed project or investment may generate. NPV can be a fair indicator of an investment’s profitability. It allows using present values to determine the potential future earnings of a project. NPV is a crucial element in decision-making processes, aiding in assessing the viability and profitability of various ventures.

In this blog, we discuss the NPV formula, list the variables to include in the formula, explain how to calculate NPV in Excel, and provide real-world examples.

How to Calculate NPV?

Here is the mathematical formula for calculating NPV after n time periods.

The discount rate is company-specific because it is related to how the company is funded. It’s the rate of return that the investors expect or the cost of borrowing money. For example, if shareholders expect a 15% return, this is the discount rate the company will use to calculate NPV. Or if the firm pays 4% interest on its debt, then it may use that figure as the discount rate. Discount rate is usually interpreted as the opportunity cost of capital.

Transform your financial analysis with our comprehensive Excel Financial Modeling Services, providing accurate and insightful models to drive informed decision-making.

Excel NPV Function

Excel simplifies the process of calculating Net Present Value (NPV) through its built-in NPV function. Let’s visit the NPV function in Excel and get familiar with the syntax and arguments.

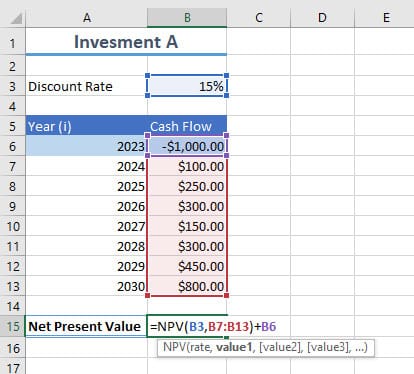

Syntax: NPV(rate,value1,[value2],…)

- rate: Required. The rate of discount over the length of one period.

- value1, value2, value 3, …: series of cash flows. value1 is required, subsequent values are optional.

Important Notes Before Using Excel NPV Function

- value1, value2, … must be equally spaced in time and occur at the end of each period.

- NPV uses the order of value1, value2, … to interpret the order of cash flows. Be sure to put them in chronological order.

- Arguments that are empty cells, logical values, or text representations of numbers, error values, or text that cannot be translated into numbers are ignored.

- For arguments that are in the form of an array or reference, only numbers in that array or reference are counted. Empty cells, logical values, text, or error values in the array or reference are ignored.

Calculating NPV in Excel

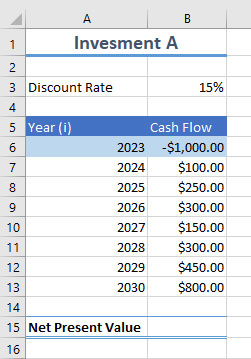

To calculate NPV in Excel, follow these steps:

- Prepare Your Data. Organize your cash flow data in a column, with each cash flow occurring in a specific period.

- Enter the Function.

- Interpret the Result.

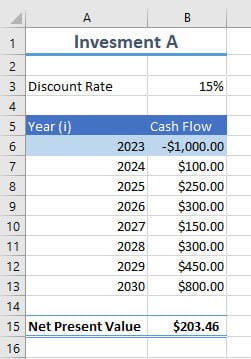

If the NPV is positive, the project will potentially make a profit. The larger the positive number, the greater the benefit to the company. However, if the NPV is negative, the project is not a good one. It will ultimately drain cash from the business. In our case, the NPV is $203 which is positive. This means that this project will be profitable.

Enhance your business efficiency with our specialized Macro Development Services, tailored to automate and streamline your operations for maximum productivity.

NPV vs IRR – Which One Should You Use?

Net Present Value (NPV) and Internal Rate of Return (IRR) are both essential financial metrics for evaluating investment projects, but they serve different purposes. The choice between NPV and IRR depends on the characteristics of your project and your specific goals.

Use NPV When

- Comparing Mutually Exclusive Projects: NPV is a reliable metric when you need to choose between multiple investment opportunities. It helps you determine which project will maximize the overall value of your investments.

- Evaluating Projects with Differing Sizes: NPV is suitable for projects with varying initial investments because it provides an absolute dollar value, making it easier to compare projects of different scales.

- There is No Reinvestment Assumption: NPV assumes that cash flows are reinvested at the discount rate. This is a more realistic assumption in most cases.

Use IRR When

- Comparing Projects with Similar Magnitudes: IRR is valuable when you’re evaluating projects with similar initial investments because it expresses returns as a percentage, making it easier to compare projects of similar sizes.

- Seeking a Clear-Cut Decision Rule: IRR provides a straightforward decision rule, choose the project with the highest IRR, provided it exceeds the required hurdle rate. It’s a valuable metric when you need a quick decision criterion.

- Assessing Capital Constraint: IRR considers the time value of money and cash flow patterns, making it a useful metric when you’re constrained by the availability of capital.

When Can NPV and IRR Give Conflicting Results, and How to Resolve Such Conflicts?

There are instances where NPV and IRR can offer conflicting recommendations, especially when cash flows exhibit unconventional patterns. In such situations, prioritize NPV. NPV is generally considered more reliable because it explicitly considers the reinvestment rate assumption, which IRR does not. If the NPV of a project is positive, it indicates that the project will increase the overall value of your investments, even if the IRR is less than your required rate of return.

In cases where IRR is preferred, consider using additional financial metrics and sensitivity analysis to gain a deeper understanding of the project’s risk and return profile. Always base your decisions on a comprehensive evaluation of both metrics and consider the unique characteristics of your investment project.

Remember that while NPV and IRR are powerful tools, they should be used in conjunction with other financial analyses and qualitative factors to make well-informed investment decisions.

FAQ

To calculate NPV without using Excel’s NPV formula, follow these steps:

Set up your data: Organize your cash flow data, including the initial investment and subsequent cash flows.

Determine your discount rate: Know the discount rate that reflects the required rate of return or opportunity cost.

Calculate the present value (PV): For each cash flow, divide it by (1 + discount rate)^n, where n is the period of the cash flow. Sum up these present values to get the NPV.

Subtract the initial cost: Subtract the initial investment (if it’s not already accounted for) from the sum of net present values.

This manual approach replicates the NPV calculation without using Excel’s NPV function.

The IRR (Internal Rate of Return) formula in Excel is:

IRR(range of cash flows, [guess])

Where

range of cash flows: The range of cells containing cash flows, including the initial investment. These should be in chronological order.

guess (optional): An estimate of the IRR. It’s not required, but you can provide it for quicker calculation convergence.

The IRR function calculates the rate at which the net present value (NPV) of cash flows becomes zero, indicating the project’s internal rate of return.

The first step in calculating NPV (Net Present Value) is to “gather all the relevant cash flows” associated with the investment or project you are evaluating. This includes identifying the initial investment (often occurring at time 0) and the expected future cash flows, which can be both positive (inflows) and negative (outflows) over a series of periods.

Our experts will be glad to help you, If this article didn’t answer your questions. ASK NOW

We believe this content can enhance our services. Yet, it’s awaiting comprehensive review. Your suggestions for improvement are invaluable. Kindly report any issue or suggestion using the “Report an issue” button below. We value your input.